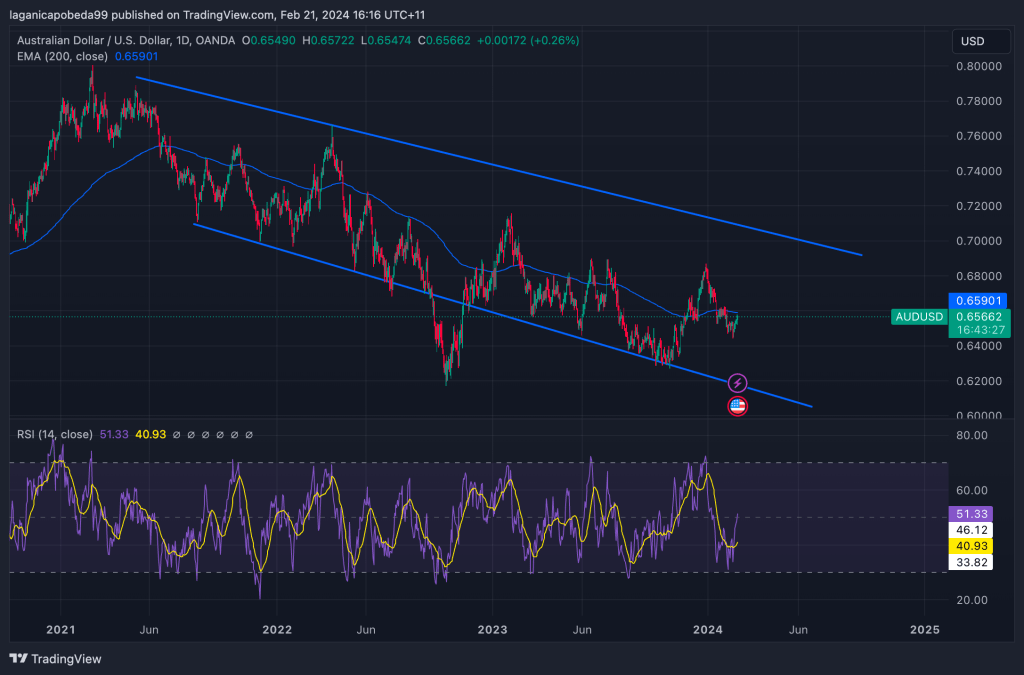

TECH OUTLOOK-Daily chart

AUDUSD has been floating around 0.63 to 0.7 range for the past few quarters now. Currently at 0.65 it’s at a steady pace towards the upside but still relatively weak compared to the previous years which averaged 0.75-0.85 . AUDUSD is just under the 200 day exponential moving average now and showing that it’s a good buying opportunity.RSI is at 40, under its 50 mark showing sold out conditions.

FUNDY

Currently the AUD has lower international buying power and is cheaper for foreigners to come to Australia and purchase its goods and services boosting export growth .

Australian GDP has been sluggish , not fully going in line with the inflation rate which was around 7% in 2023 whilst the GDP rose September 2022 to September 2023 to 2.1% nominally.

Current yearly CPI is at 4.9% whilst the cash rate at 4.35%.

For America CPI is at 3.1% , cash rates at 5.5%.

ASX200 sitting at 7600 , just under its record high of 7700. Lowering the interest rates in the future for both FED and RBA will lift up the Stock Market even further up.

US 10yr bond yields are up at 4.275% . Quarterly high was 5% and a low of 3.8% .

CALENDAR

Chinese Central Bank has lowered its 5 year Lending rate by 25 basis points to 3.95% to assist with economic growth and stabilise the property market. This week the Feds meeting to see if they will lower rates , the speculation on the Street is that it will have to wait till June with 53% of surgery respondents sure that its going to be then.