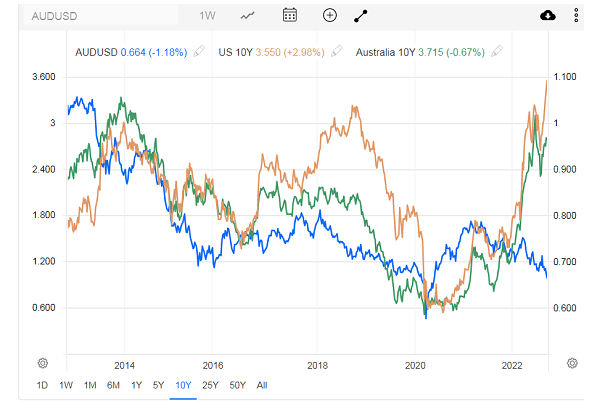

The AUDUSD pair hit a low of 0.6580 before it went back to the 0.66 levels after FED Lifted its nominal interest rate from 2.5% to 3.25% to fight inflation which this year has been over 8% in the USA.

This weakness in AUD has not been seen since April 2020 when the lockdowns and lowering of interest rates crashed the Australian Dollar.

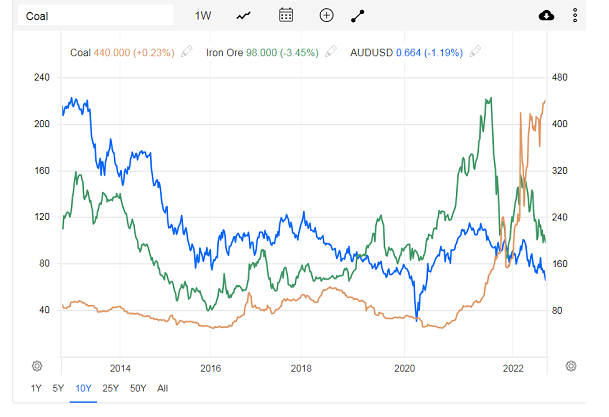

When RBA held its interest rates were higher than the FED , AUD held its strenght but now that its interest are lower, the AUD is sinking to new lows . The only thing that saves the aud from sinking even lower are the high prices of export commodities.More than 75% of australian exports are minerals and metals, once that value goes down, AUDUSD could easily sink to new lows of 0.50 . Then the RBA would have to lift its interest rate even higher to keep the strenght of AUD .

Leave a comment